Charitable gift annuities

Gift annuities are easy to establish with a minimum gift of $20,000 and are available to donors 55 and over. Immediate, Deferred, and Flexible gift annuities can help donors meet their unique needs. And, for the first time in years, recommended annuity rates are up!

Sample rates for an individual at their nearest birthday as of January 1, 2024

| Current Age | 65 | 70 | 75 | 80 | 85 | 90 |

| Rate | 5.7% | 6.3% | 7.0% | 8.1% | 9.1% | 10.1% |

Learn more about how a charitable gift annuity can help you achieve your goals and support individuals and families in need, then contact Stephanie Casenza at (415) 592-2802 or SCasenza@stanthonysf.org .

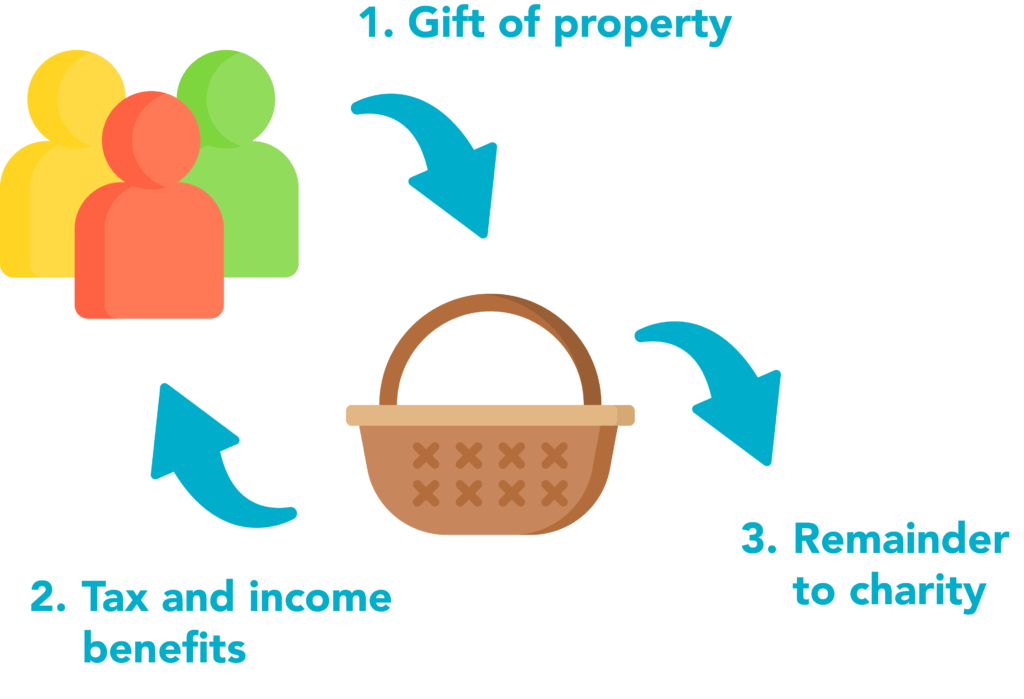

Charitable remainder trusts

Charitable remainder trusts (CRTs) convert assets into income for one or more income beneficiaries. Donors who fund their trust with a gift of appreciated assets, like securities or real estate, do not pay capital gains tax when those assets are sold. Donors receive an immediate income tax deduction when their trust is created, and assets transferred to a charitable remainder trust reduce the donor’s taxable estate. When the trust expires, the remainder goes to St. Anthony’s to provide hope to people in need.